CBAM: From standard values to real data

The third CBAM report for Q2 2024 can be submitted for the last time using default values for emissions data. This will no longer be the case starting with the fourth CBAM report for Q3 2024, which must be submitted by October 31, 2024. Reporting entities will then be required to provide real data on the emissions of the CBAM goods they import into the EU. This poses significant challenges for both the reporting companies in the EU and the suppliers in third countries who are required to participate in the collection of CBAM data.

1) Background

The Carbon Border Adjustment Mechanism (CBAM) is a climate regulation measure implemented as part of the EU's "Fit for 55" package, which is already having a global impact. The CBAM regime was introduced by a directly applicable regulation in the EU member states (Regulation (EU) 2023/956 of May 10, 2023) to protect the European economy from competitive disadvantages: The CO2 pricing of products manufactured in third countries is intended to create a level playing field compared to European products that are subject to costs from the EU Emissions Trading System. To achieve this, obligated companies must report quarterly on the embodied emissions of imported CBAM goods during a transitional phase from October 1, 2023, to December 31, 2025. The affected CBAM goods are identified by their CN number. This currently includes products from the steel, iron, aluminum, cement, fertiliser, electricity, and hydrogen sectors. The catalog of CBAM goods already includes approximately 750 CN numbers. Reports must be uploaded to the EU Commission's so-called "CBAM Transition Register." Companies must also indicate whether a CO2 price for greenhouse gas emissions has already been paid in the third country for these products, and whether any reimbursements have been made.

2) Transition Phase and Main Phase

The first CBAM report for Q4 2023 was due to be uploaded to the EU Commission by January 31, 2024. This requirement caught many companies off guard. According to the the European Commission, of the more than 70,000 companies required to report in the European Union, only approximately 17,000 had submitted an initial CBAM report. However, there is no hope of any easing of the situation – on the contrary, the regulations will likely become even stricter. The EU Commission has announced that it intends to evaluate by the end of 2025 which additional goods should be subject to CBAM regulation in the future. The main areas under discussion are basic materials from the chemical industry and products from refineries, which would significantly expand the scope of application. When the CBAM regulation enters its main phase at the beginning of 2026, reporting entities will have to purchase certificates for the embodied emissions of imported products. The price of a CBAM certificate will be based on the certificate price of the EU ETS. At the latest then, the emission intensity of a product – its carbon footprint – will become an essential component of the product price, and with increasing importance given the trend towards rising CO2 certificate prices.

3) Use of Default Values for Emissions Data

Initially, standard values were permitted to be used to report emissions data in the CBAM report – for the first three reports, up to and including the report for Q2 2024. According to the legal definition of the regulation, "standard values" are values calculated or derived from secondary data (Article 3 No. 27 of the CBAM Regulation). On December 22, 2023, the EU Commission published a communication on such standard values for the transitional phase.

Starting with the report for Q3 2024, this is generally no longer permitted. The goal of the CBAM regulation is to ensure that the determination of actual direct and indirect emissions is practiced during the transitional phase until the end of 2025.

Starting with the CBAM report for Q3 2024, default values can only be based on estimates provided by installation operators for up to 20% of total embodied emissions associated with complex goods (see Article 5 of the CBAM Implementing Regulation (EU) 2023/1773 of 17 August 2023). This is intended to provide some flexibility; Recital 10 of the CBAM Implementing Regulation states:

"For those production stages in installations that do not account for a significant share of the direct embodied emissions of imported goods, the reporting requirements should also provide for some flexibility. This would typically be the case for the final production stages for downstream steel or aluminum products. An exception to the prescribed reporting requirements should be provided for these stages, and it should be possible to provide estimates for production stages in installations whose direct emissions do not exceed 20% of the total embodied emissions associated with imported goods. This threshold should provide sufficient flexibility for small operators in third countries."

This means that estimates apply to production stages in installations whose direct emissions do not exceed 20% of the total embodied emissions associated with imported goods. There are special rules for the import of electricity. Apart from these exceptions, the regulations require the use of real data. This has been criticized but does not appear to be changing at present.

Determination of Real Data

The determination of the real data required for CBAM reporting follows a specific logic. This logic does not correspond to the methods used for product carbon footprint calculations, such as those laid down in the Greenhouse Gas Protocol, on which the ISO 14064 standard is based. Therefore, emissions data from existing queries are generally not directly usable for CBAM purposes.

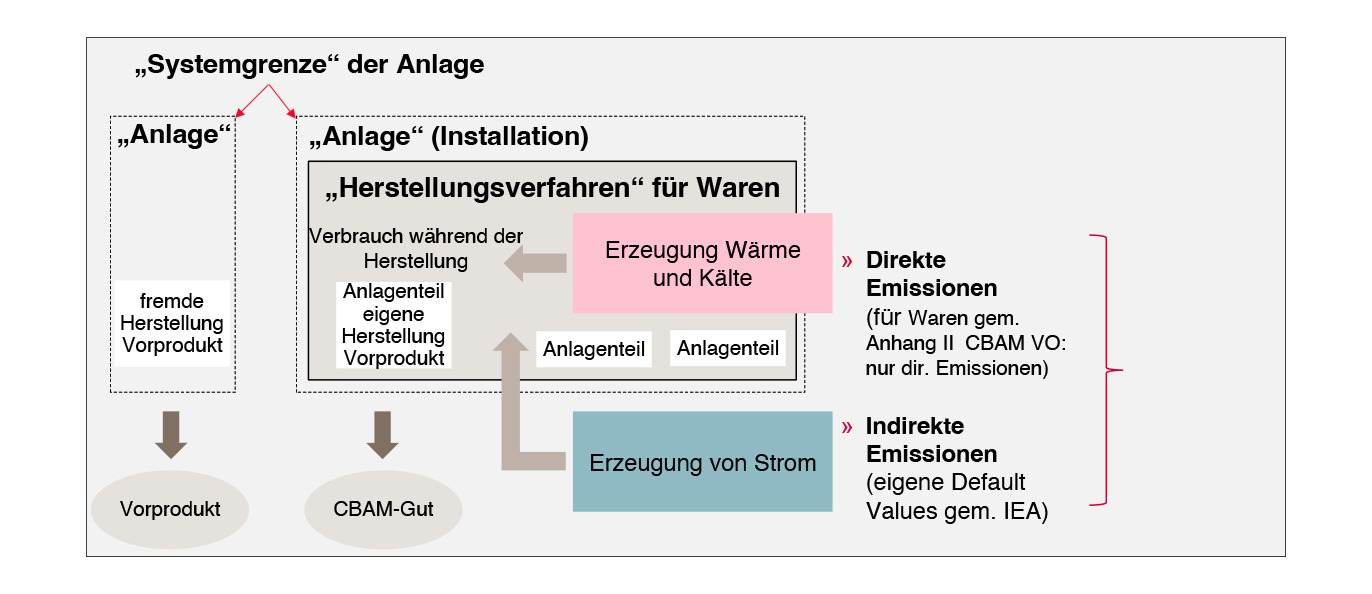

The CBAM methodology corresponds more closely to the methodology of the EU ETS and does not consistently include emissions from Scope 2 and Scope 3. Furthermore, the "system boundaries" of the (production) facility from which this CBAM good originates must be defined for each CBAM good in order to determine which emissions are included in the analysis based on the manufacturing process used. The consideration of emissions from the production of certain intermediate products – differentiated for the iron and steel, aluminum, cement, and fertiliser sectors – makes matters even more complex.

According to the legal definition of the regulation, these are "actual emissions" if the emissions are measured and calculated based on primary data from the processes used to manufacture goods (Article 3 No. 28 CBAM Regulation). There are special determination procedures for emissions from the generation of electricity consumed during these processes.

The determination of such actual data is also complex. It is regulated in high technical detail in the annexes to the CBAM Implementing Regulation, and the EU Commission has published supplementary guidance for importers and plant operators, most recently on May 30, 2024. Different requirements apply to products from the affected sectors, especially regarding emission data for relevant precursors.

In principle, the following information regarding emissions is required for CBAM reports:

The total quantity of imported CBAM goods (in tonnes or megawatt-hours, broken down by the (production) facilities that produce these CBAM goods in the respective country of origin);

The total (specific) emissions – both direct and indirect emissions (in tonnes and per unit of goods); and

The CO₂ price that must be paid in the country of origin for the emissions associated with the imported goods; this includes refunds or any other form of compensation.

Although the reporting party has data on the total quantity of imported CBAM goods, it does not have data on the total actual direct and indirect emissions. They also have no access to the facility data and cannot assign the imported goods to specific facilities. Therefore, the only remaining option is to inquire with the suppliers or, if they act as traders, with the upstream suppliers. In many cases, these companies won't yet have emissions data available. And if they do provide data, it will often be unreliable. During the transition phase, there is no obligation for testing by certified bodies.

Querying Real Data from Suppliers

The current CBAM discussion therefore focuses on the question of how CBAM reporters can obtain reliable data on the CO2 emissions of imported products.

Retrieving real data poses significant challenges for both reporting entities, who must request this data from their suppliers in third countries, and for the suppliers themselves. The Excel template ("Communication Template") provided by the EU Commission for query purposes has proven to be unsuitable in this regard. It does not filter for data that is truly relevant to the respective product of the supplier in question and fails at the very latest when it needs to be passed on in supply chains and subsequently consolidated. In this case, software-based data retrieval via an electronic portal can significantly simplify and clarify the processes.

In practice, it has also been shown that suppliers generally require training to understand exactly what cooperation obligations are required of them. Unfortunately, the CBAM data retrieval procedure prescribed by the regulation is not self-explanatory. In any case, it is recommended that the suppliers' obligation to cooperate in the collection and transmission of CBAM data be explicitly stipulated in the general terms and conditions or supply contracts of the CBAM notifier or importer. This is particularly important given that the CBAM notifier may face significant sanctions for violations of CBAM obligations.

From the perspective of reporting entities, the query process is of considerable importance for regulatory reasons. In order to avoid sanctions, it is necessary to demonstrate that the "necessary measures" (see Article 16 of the CBAM Implementing Regulation) have been taken to obtain the necessary real data. The practice of the national CBAM authorities (in Germany, the German Emissions Trading Authority – DEHSt) will determine how many reminders are necessary in this case and whether it is necessary to prove that the suppliers have received the necessary explanations. One thing is certain: The reporting entity's efforts to implement the necessary measures to comply with CBAM obligations must be taken seriously for compliance reasons and carefully documented, if necessary using a software-based solution. Because it is expected that the authorities' grace period will expire during the transition phase.

Personal Details

Dr. Sabine Schulte-Beckhausen

- Born in 1965

- 1984-1990 Law studies in Bonn, Freiburg, and Lausanne (CH)

- 1990/1991 Research assistant at the University of Geneva (CH)

- PhD in 1994

- 1994-2001 Association of Municipal Enterprises (VKU), European Department

- 2001-2008 Sal. Oppenheim Bank, Investment Banking

- 2008-2024 Attorney specializing in energy and climate protection law at White & Case, GÖRG, and WTS

- Since August 2024 Partner at MAYGREEN Tax & Legal PartGmbB

s.schulte-beckhausen@maygreen-taxlegal.de

Dr. Karen Möhlenkamp

- Born in 1968

- 1989 – 1993 Studied law in Würzburg

- 1994/1995 Research assistant at the University of Rostock

- PhD in 1997

- 1999 – 2006 Federation of German Industries (BDI)

- 2007 – 2024 Partner and Managing Director at WTS GmbH

- Since August 2024 Partner at MAYGREEN Tax & Legal PartGmbB